nd sales tax form

North Dakota Sales Tax Filing Address. OFFICE OF STATE TAX COMMISSIONER CERTIFICATE OF RESALE SFN 21950 11-2002 I hereby certify that I hold _____ Sales and Use Tax permit number_____.

Purpose of form North Dakota Schedule K-1 Form 58 is a supplemental schedule provided by a partnership to its partners.

. People also ask canadian residents request for sales tax refund form north dakota. Ad Automate Standardize Taxability on Sales and Purchase Transactions. Ad Sales Tax Nd Same Day.

Ad Have you expanded beyond marketplace selling. Each Tax Administration Practice is in the Library of Tax Administration Practices in the Streamlined Sales and Use Tax Agreement SSUTA as amended through December 21 2021. Decide on what kind of signature to.

TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view. Prepare and file your sales tax with ease with a solution built just for you. Sales Tax Nd- Current Update Feb 2022.

The state sales tax rate in North Dakota is 5000. Ad Download or Email ND Form 306 More Fillable Forms Register and Subscribe Now. Manage your North Dakota business tax accounts with Taxpayer Access point TAP.

Our tax preparers will ensure that your tax returns are complete accurate and on time. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax. If you do not have a state tax identification number enter the Federal.

Guideline at wwwndgovtax salesanduseguidelines. Office of State Tax Commissioner PO Box 5623 Bismarck ND 58506-5623 Taxpayers may also file North Dakota sales tax returns by completing and. Prepare and file your sales tax with ease with a solution built just for you.

North Dakota has recent rate changes Thu Jul 01. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up. Select the document you want to sign and click Upload.

Special Taxes at 7013281246 or salestaxndgov. Avalara can help your business. If you have a North Dakota Sales Tax Permit please use ND TAP to submit any sales and use tax you owe when you file your return.

Total on line 4. North Dakota Sales Tax Reporting Form. Avalara can help your business.

Application Forms for Exemption Numbers or Direct Pay Permits. Are there state taxes in North Dakota. Ad Download Or Email ND Form ST More Fillable Forms Register and Subscribe Now.

Tax Return Forms Schedules. The One Time Remittance form is for one-time sales and. It provides information the partners may need to complete their.

Please call 701-231-7432 ACCT-NDSalesTaxReportingLongForm - REV 042019. North Dakota Sales Tax Exemption Resale Forms 2 PDFs. Enter one invoice per line.

Ad Download Or Email ND Form ST More Fillable Forms Register and Subscribe Now. Line 4 Taxable Balance -. Follow the step-by-step instructions below to design your nd form sales tax.

I am engaged in the business. North Dakota Sales Tax Exemption Number E-0000 issued to them by the North Dakota Office of State Tax Commissioner. Be the First to Know when North Dakota Tax Developments Impact Your Business or Clients.

With local taxes the total sales tax rate is between 5000 and 8500. Questions about this form. Line 5 State Tax - Multiply the.

North Dakota levies one of the lowest progressive state income. Claim for Refund Forms. Floridas general state sales tax rate is 6 with the following exceptions.

INVOICE DATE INVOICE NUMBER. Enter the amount total of line 1 plus line 2 minus line 3. Sales Tax Taxpayer Access Point TAP North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders.

Page 1 of 2. If you are a retailer making purchases for resale or need to make a purchase that is exempt from the North Dakota sales tax you. Ad Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos.

PdfFiller allows users to edit sign fill and share all type of documents online. Ad Have you expanded beyond marketplace selling. Thursday June 23 2022 - 0900 am.

ST - Sales Use and Gross Receipts Tax Form North Dakota Office of State Tax Commissioner I declare that this return has been examined by me and to the best of my knowledge and belief is. Ad Expert News Commentary Trusted Analysis Time-saving Practice Tools. Integrate Vertex seamlessly to the systems you already use.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Copies of all invoices must be provided with refund claim.

North Dakota Sales Tax Handbook 2022

Understanding Your Property Tax Statement Cass County Nd

3 12 16 Corporate Income Tax Returns Internal Revenue Service

Sales Tax Guide For Online Courses

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

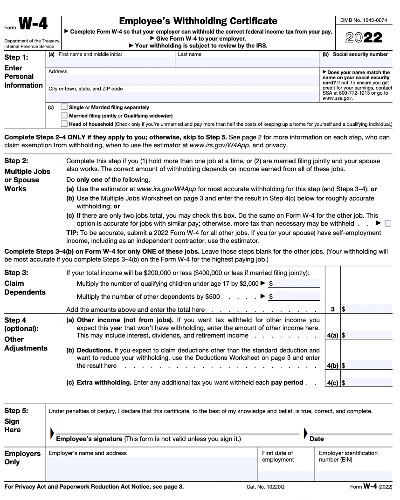

What Is A W 4 Form How It Works Helping Your Employees Complete It

Where S My Refund Of North Dakota Taxes

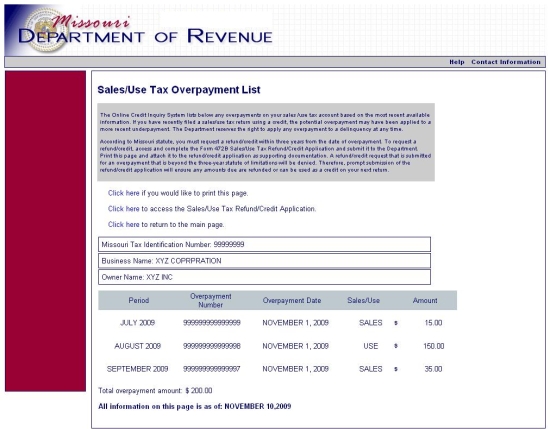

Sales Use Tax Credit Inquiry Instructions

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

Tax Form Templates 5 Free Examples Fill Customize Download

Sales Tax Campus Controller S Office University Of Colorado Boulder

State Corporate Income Tax Rates And Brackets Tax Foundation

95 Bill Of Sale Form Free To Edit Download Print Cocodoc

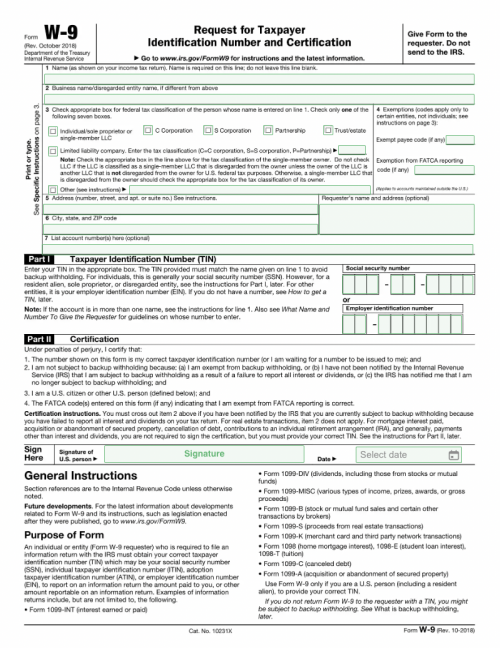

W 9 Tax Form 2018 2021 Fill Out Online Download Free Pdf